Prosper concludes distribution partnership with US asset manager TCW

Press release – November 13, 2020

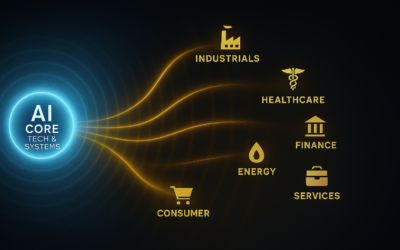

Geneva-based fund distribution company Prosper Professional Services will distribute the UCITS strategies of Californian fund manager TCW in French-speaking Switzerland. Specialist in US core bonds, TCW is also recognised for its high yield strategy, flexible Cash Plus and emerging debt products, as well as for its thematic equity funds (global ESG, artificial intelligence). As part of the partnership, Prosper will offer the funds of the Luxembourg SICAV TCW Funds, most of which are authorised for public distribution in Switzerland. With this agreement, Prosper enhances its range of investment solutions, which already includes ELEVA funds among others.

TCW, a leading fixed income specialist

Founded in 1971 in Los Angeles, California, the TCW Group manages USD 235 billion in assets and has more than 600 employees in 10 offices in the United States and around the world. TCW caters to professional investors, including financial advisors, financial institutions, foundations, the world’s largest pension funds, sovereign wealth funds and central banks.

The Luxembourg SICAV TCW Funds was created in 2012 to further expand TCW expertise accross Europe in a recognized UCITS format. The SICAV offers 10 segregated funds today representing more than USD 1.3 billion in assets under management (MetWest Total Return Bond Fund, MetWest Unconstrained Bond Fund, TCW Income Fund, TCW Global Securitized Fund, MetWest High Yield Bond Fund, TCW Emerging Markets Income Fund, TCW Emerging Markets Local Currency Income Fund, TCW Select Equities Fund, TCW Global Artificial Intelligence Equities Fund, TCW Global Premier ESG Equities Fund). These funds are available in several share classes and reference currencies.

Significant outperformance is achieved through a disciplined and active management philosophy, applied to both equity and fixed income investments. As a result, most of its strategies are well ranked at Citywire and rated 4 or 5 stars by Morningstar.

Prosper: a distributor of cherry-picked, top-performing, must-have strategies

Founded in 2009 in Geneva, Prosper Professional Services is a Swiss regulated fund distribution company offering a selection of high value-added strategies to professional clients based in Switzerland. With this new agreement, Prosper expands its range of investment solutions, which already includes the ELEVA funds and the strategies of Plurimi and Roubaix Capital within the Prosper Sicav.

Thierry Robin, Founder of Prosper, commented: “We are very pleased to be able to bring TCW’s expertise to the Swiss French-speaking market. Indeed, in almost 50 years, TCW has established itself as one of the leading US asset managers, particularly in the bond sector. TCW has developed a unique know-how that enables it to make a real difference. With this partnership, we are continuing our service mission by being the link between global asset managers and Swiss wealth managers.”

Charles Barnick, Head of Business Development Europe at TCW, added: “The Swiss market is one of the key countries in our European development strategy. We are delighted to have found in Prosper the ideal partner to accelerate the development of our strategies in this demanding and sophisticated market.”

For further information, please contact :

Prosper Professional Services SA

T: +41 (0)22 752 69 69

www.prosperfunds.ch

Thierry Robin Mily Phan

thierry@prosperfunds.ch mily@prosperfunds.ch

Publication – Allnews – November 13, 2020 (FR)

Publication – Finance Corner- November 13, 2020 (FR)

Publication – Citywire – November 13, 2020 (FR)

Publication – Investir.ch – November 16, 2020 (FR)

Legal disclaimer

This document is issued for information purposes only and should not be considered as an offer to sell or subscribe. It does not constitute the basis of a contract or commitment of any kind. This document may not be copied, distributed or communicated, directly or indirectly, to any other person without the express consent of Prosper Professional Services SA (hereinafter “Prosper”).

The information provided in the document is not intended to be a substitute of the funds’ fund documentation. Hence, nothing contained in this document should be construed as financial, legal, accounting, tax or investment advice or as an offer of services or products. It should not be used as a basis for any investment or other decision. Any investment decision should be based on appropriate professional advice specific to the needs of the investor.

Prosper makes every effort to ensure that the information provided is accurate and complete at the time of inclusion. However, Prosper and the investment funds mentioned do not guarantee, explicitly or implicitly, that it is accurate, reliable, up to date and/or exhaustive. The information and opinions contained in the document are provided for personal use and information purposes only and are subject to change at any time without notice. Prosper accepts no liability for any direct and/or indirect and/or consequential loss incurred in connection with the use of the information contained in this document.

The products and services described in this document may be subject to restrictions for certain persons and/or in certain countries. It is incumbent of interested persons to take all appropriate steps to ensure that they do not solicit Prosper for products and services which, due to the laws of their country of origin or any other country, may be prohibited or require special authorisation by such persons or the company.

This document contains information on investment funds registered, respectively managed, in different jurisdictions. It is your responsibility to verify that you are authorised to access the contents of this document.

An investment in investment funds should only be made after having carefully read the official documents of the fund such as the latest prospectus, simplified prospectus or the Key Investor Information Document (KIID), the management regulations, respectively the articles of association, the annual and semi-annual reports. These documents may be obtained free of charge from the representative of the investment fund in the country of residence of the fund and/or in the countries in which it is registered.

The funds described apply a policy of subscription, conversion and redemption at unknown price, with pricing after the close of the markets. Practices such as “late trading” or late trading and “market timing” or market synchronisation are not permitted.

Tax treatment depends entirely on the financial situation of each investor and may be subject to change.

Prosper News

Découvrez les derniers commentaires et analyses des gérants des fonds

Prosper Stars & Stripes – Market Review Q4 2025

Prosper Stars & Stripes : Review Q4 2025 by Christopher Hillary, Roubaix Capital CEO and Fund Manager. During the fourth quarter of 2025, Prosper Stars & Stripes generated a net return of +1.2% compared to a total return of +2.2% for the Small and Mid...

TCW in the news- December 2025

December 2025US FIXED INCOME : BACK TO CAUTIOUS OPTIMISM Prosper - December 5th, 2025Despite the current gloomy backdrop in the United States and the “natural” pessimism of most fixed income managers, US bond specialist TCW is taking a more positive view of 2026. This...

Prosper Stars & Stripes – Market Review Q3 2025

Prosper Stars & Stripes : Review Q3 2025 by Christopher Hillary, Roubaix Capital CEO and Fund Manager. During the third quarter of 2025, Prosper Stars & Stripes outperformed, generating a net return of +9.8% compared to a total return of +12.4% for the...

Retour

Retour