TCW Core Plus Bond Fund

LU0905645874

CLASS IU (USD)

100.00 19/04/2013

A diversified Investment Grade bond fund

An Investment Grade bond fund benchmarked to the Bloomberg US Aggregate Bond Index, actively managed by credit specialists with a bottom-up and value approach. The objective of TCW Core Plus is to beat its benchmark by investing in a broad range of segments across the fixed income universe, such as US treasuries debt, Investment Grade, High Yield, and securitized debt.

Relative duration from its benchmark does not deviate more than 1 year (+/-) and the portfolio is highly diversified with a high average credit quality (always between A and AAA). In addition, the fund is categorized as Article 8 by SFDR regulation. TCW Core Plus provides diversification with an emphasis on capital preservation.

Bryan

Whalen

CIO,

Generalist PM

Ruben

Hovhannisyan

Group MD,

Generalist PM

Jerry

Cudzil

Group MD,

Generalist PM

Potentially lower rewards

Potentially higher rewards

PERFORMANCE

Historical monthly returns (in %)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | |

| 2026 | 0.1 | 0.1 | |||||||||||

| 2025 | 0.6 | 2.5 | 0.0 | 0.2 | -0.7 | 1.7 | -0.5 | 1.3 | 1.1 | 0.7 | 0.7 | -0.3 | 7.5 |

| 2024 | -0.1 | -1.8 | 1.0 | -3.0 | 1.9 | 1.2 | 2.6 | 1.6 | 1.4 | -3.0 | 1.3 | -2.1 | 0.7 |

| 2023 | 3.6 | -2.9 | 3.0 | 0.5 | -1.3 | -0.6 | 0.1 | -0.7 | -3.0 | -2.1 | 5.1 | 4.4 | 6.0 |

| 2022 | -2.1 | -1.2 | -2.8 | -4.1 | 0.5 | -2.1 | 2.9 | -3.1 | -5.0 | -1.5 | 3.9 | -0.4 | -14.3 |

| 2021 | -0.6 | -1.4 | -1.1 | 0.8 | 0.2 | 0.7 | 1.0 | -0.1 | -0.8 | -0.1 | 0.2 | -0.3 | -1.3 |

| 2020 | 2.0 | 1.6 | -0.9 | 2.2 | 0.6 | 0.9 | 1.6 | -0.6 | 0.0 | -0.4 | 1.2 | 0.3 | 8.8 |

| 2019 | 1.1 | 0.0 | 1.9 | 0.0 | 1.9 | 1.2 | 0.3 | 2.5 | -0.6 | 0.3 | 0.0 | -0.1 | 8.9 |

| 2018 | -1.0 | -0.9 | 0.6 | -0.7 | 0.8 | -0.1 | -0.1 | 0.7 | -0.7 | -0.7 | 0.5 | 1.7 | 0.1 |

| 2017 | 0.3 | 0.6 | 0.0 | 0.7 | 0.7 | -0.1 | 0.3 | 0.9 | -0.5 | 0.0 | 0.1 | 0.2 | 3.2 |

| 2016 | 1.2 | 0.5 | 0.7 | 0.4 | 0.1 | 1.5 | 0.7 | 0.0 | 0.1 | -0.7 | -2.0 | 0.1 | 2.5 |

| 2015 | 1.9 | -0.8 | 0.4 | -0.3 | -0.3 | -0.9 | 0.6 | -0.2 | 0.4 | 0.1 | -0.2 | -0.3 | 0.3 |

| 2014 | 1.6 | 0.4 | 0.0 | 0.8 | 1.1 | 0.2 | 0.0 | 0.6 | -0.5 | 1.0 | 0.7 | 0.2 | 6.1 |

| 2013 | 0.4* | -1.8 | -2.3 | 0.1 | -0.3 | 1.2 | 0.9 | 0.0 | -0.6 | -2.4 |

*Since inception (April 19th 2013) to December 31st 2013.

Figures based on month-end NAVs

Statistics (in %) as of 30 jan 2026

| Performance | Risk | |||||||

| 1M | 3M | 6M | 1Y | 3Y | Since inception | Annualized volatility | Max DD | |

| Fund | 0.1 | 0.5 | 3.7 | 7.1 | 10.9 | 26.6 | 5.1 | -18.3 |

First NAV : 19Apr2013 – NAV at inception : USD 100.

All figures based on month-end NAVs. Risk data calculated since inception.

Information

| Fund Type | Luxembourg SICAV – UCITS |

| Income treatment | Accumulation / Distribution, according to classes |

| Launch date | 19 April 2013 |

| Base currency | USD |

| Available currencies | USD EUR, GBP, CHF (hedged & unhedged) |

| Manager | TCW Investment Management Company LLC www.tcw.com |

| Quotation (NAV calcultation) | Daily (business days) |

| Administrator | Société Générale, Luxembourg Branch |

| Subscription/Redemption | Day D, cut-off 5pm CET |

| Management fee | 0.40% p.a. for classes I 0.80% p.a. for classes A |

| Performance fee | None |

| Min. initial investment | Class A : None Class I : USD 1 mio or equivalent |

| Lock-up | None |

| Commercial fees (entry/exit) | None |

| Custodian bank | Société Générale, Luxembourg Branch |

| Auditors | Deloitte Audit |

| Swiss legal representative | Acolin Fund Services AG |

| Registration for distribution | BE, CH, DE, ES, FR, GB, IT, LU (as per shares) – Contact us |

TCW FUNDS LATEST NEWS

TCW – Webinar – March 5th 2026

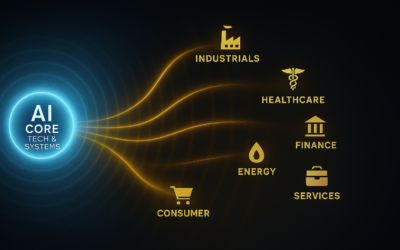

WEBINAR - Thursday, March 5th 2026From Technological Foundation To Productivity Gains: The AI Investment Opportunity Has Only Just BegunThursday, March 5th - 4pm (CET) Webinar hosted in english Hosted by Bo Fifer LEAD PORTFOLIO MANAGER OFTCW GLOBAL AI...

TCW in the news- December 2025

December 2025US FIXED INCOME : BACK TO CAUTIOUS OPTIMISM Prosper - December 5th, 2025Despite the current gloomy backdrop in the United States and the “natural” pessimism of most fixed income managers, US bond specialist TCW is taking a more positive view of 2026. This...

TCW – Q3 2025 Talking Points

TCW Q3 2025 TALKING POINTS The TCW Group comments the Fixed Income market for the third quarter 2025 and presents its views going ahead. Please click on the link below to read the TCW Q3 2025 Talking Points.PROSPER NEWS Get the latest fund...

PROSPER EVENTS

If you wish to meet a manager, get updates on a fund, don’t hesitate to attend Prosper’s events ("Les Rencontres Prosper"). You can now subscribe online.

Wish to be informed ahead of the crowd through our emails?

Sign up to participate in the next events & presentations.

Retour

Retour